Broxton BDC Income Fund

The fund handily outperforms investment grade, preferred and high yield indexes. The fund tracks the performance of the largest Business Development Companies that are listed and incorporated in the United States. A Business Development Company (BDC) is a type of closed-end investment company that provides capital to small and medium-sized businesses and has distinct advantages. The investor gains exposure to a diversified portfolio of companies that are similar to private debt funds but offer greater liquidity and transparency.

-

BDCs have:

-

Floating rate investments offering protection from interest rate volatility

-

management assistance for borrowers

-

securitization of investments leading to higher and more secure returns

-

Each BDC has hundreds of portfolio company investments spread across diverse geographies

FACT SHEET

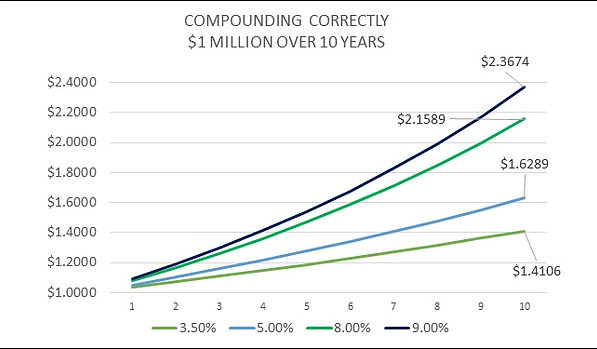

As shown below: Over time, the compounding rate is the most important variable for an income portfolio or allocation. The difference can be hundreds of thousands of dollars in withdrawals or additional savings. The difference between 5% and 8% for a $1 million account is $503,000 over 10 years. The objective of Smart Yield is to increase the interest rate or compounding rate.